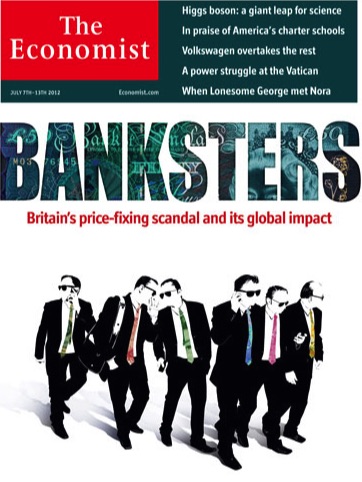

“Culture can be a very complex issue as it involves behaviours and attitudes. Efforts should be made by financial institutions and by supervisors to understand an institution’s culture and how it affects safety and soundness.” - Financial Stability Board (FSB)

“Subcultures should adhere to the high level values and elements to support the institution’s overall risk culture.” - Financial Stability Board (FSB)

“While risk culture is widely recognized as critical to effective corporate governance and risk management, the financial services industry continuous to struggle in translating the concept into tangible results.” - Risk Management Association (RMA) and Protivity

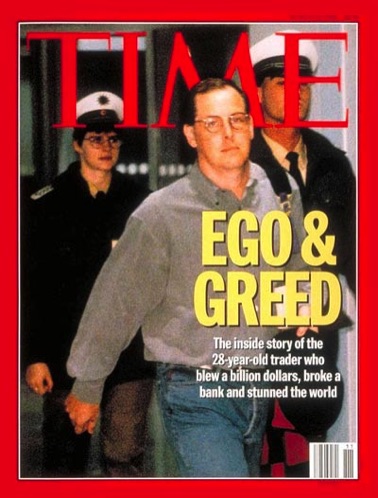

“Risk culture is at the forefront of banks' agenda as fines and remediation hit home.” - Ernst & Young (EY)

“A firm can have what appears to be most sophisticated procedures and follow a code of governance, its success relies on the people witin. People can make perfectly designed and executed systems fail but, equally, they can make poorly designed systems work actually rather well.” - the Association of Chartered Certified Accountants (ACCA)

“Industry executives are concerned that they may not be able to identify metrics capable of specifying control over ‘soft risk’ factors such as behavior.” - Thomson Reuters

“Problems with risk culture are often blamed for organisational difficulties, until now there was very little practical advice around what to do about it. Relatively little has been done by practicioners, regulators or academics to explore how culture impact on risk taking and control decisions.“ - Centre for Analysis of Risk and Regulation (CARR)

“Risk Management, the behavioural element is missing: why do individuals groups and organisations behave the way they do and how does this affect all aspects of the management of risks.” - The Institute of Risk Management (IRM)